What is Net Promoter Score (NPS)?

What is a Net Promoter Score (NPS)?

The Net Promoter Score, or NPS®, enables organizations to get a clear view of the health of their customers’ loyalty. Used widely across the globe, Net Promoter Score has become a key metric in customer engagement since its launch in 2003. It offers a model that links customer loyalty to financial KPI’s and profitable growth.

Why is a Net Promoter Score important?

Knowing your Net Promoter Score offers a variety of valuable business benefits:

- Creating a strategy that targets Promoters, Passives and Detractors. You can close the loop with your Detractors or leverage positive word of mouth with your Promotors.

- Dynamic tracking for key areas of your business, such as customer success. For example, tracking your relationship NPS over time shows how your your CX initiatives are having an impact on customer loyalty.

Transactional vs. Relational NPS surveys – not all NPS surveys are created equal

You will often see reference to two types of NPS surveys: transactional and relational.

A transactional NPS survey is designed to measure your NPS at certain moments on the customer journey, such as after your customer buys a product, or visits your location in person. Tapping the smiley face on the screen as you exit the restroom is an NPS survey, for example.

They are quick, easy and can be scaled up to ask just one question (plus an open-ended option) at each touch point. Because it’s so simple, you will have strong response rates and a large amount of resulting data for analysis. You’ll also quickly see which points of the customer journey are frictionless or, worse, causing customer dissatisfaction. However, is that really providing the insight you need?

NPS is, by its nature, a relationship metric; as such, we at Forsta do not recommend using it in a transactional context. Understanding the customer experience along the journey via transactional listening is critically important, but we find that NPS is not the best metric to use in this sense. If you want to focus on transactional behaviours, then there are better metrics.

These include:

- Overall satisfaction

- Customer Effort (e.g., ease of doing business)

- Likelihood to purchase in the future

- Whether or not your objective was achieved

When should you use a Net Promoter Score survey?

NPS is, at its core, a measurement of the relationship between customer and organization. As such, it makes more sense to use NPS in the context of a relationship survey.

A relational NPS survey offers a 30,0000-mile-high view of your customer loyalty and satisfaction levels. It shows you how customers feel about your brand, and the relationship they have with you. Think of it as your annual medical review for your brand’s health. Tracking the relational NPS over a longer period and being able to spot trends will give you the insight into how to grow your relational NPS score. You can benchmark your own year-on-year performance, and size yourself up against industry NPS standards.

What if your focus is on more transactional aspects? Despite some advocates, NPS is not the best metric in every case.

Rather, look at what transaction you want to assess, and choose a KPI (Key Performance Indicators) that’s aligned with long-term success:

Purchase experience – Overall satisfaction with the purchase can be an effective KPI, using a proxy for future behavior. For example, ask your customers “Based on your purchase experience, how likely are you to purchase from Company X in the future?”). Their answer can provide valuable insight about their future intentions toward your company.

Customer support – Customer effort (ease of doing business/ease of resolution) is a frequently-used metric. A simple assessment of if the customer considers their issue resolved can also be illuminating – it is common for the organization to assume the issue is resolved, only to find that the customer considers the issue open.

Repair experience – Overall satisfaction with the repair process is a frequently-used KPI; this is often coupled with an assessment of the amount of time the repair took (and/or whether the repair was completed in the first try.

How to create a Net Promoter Score survey

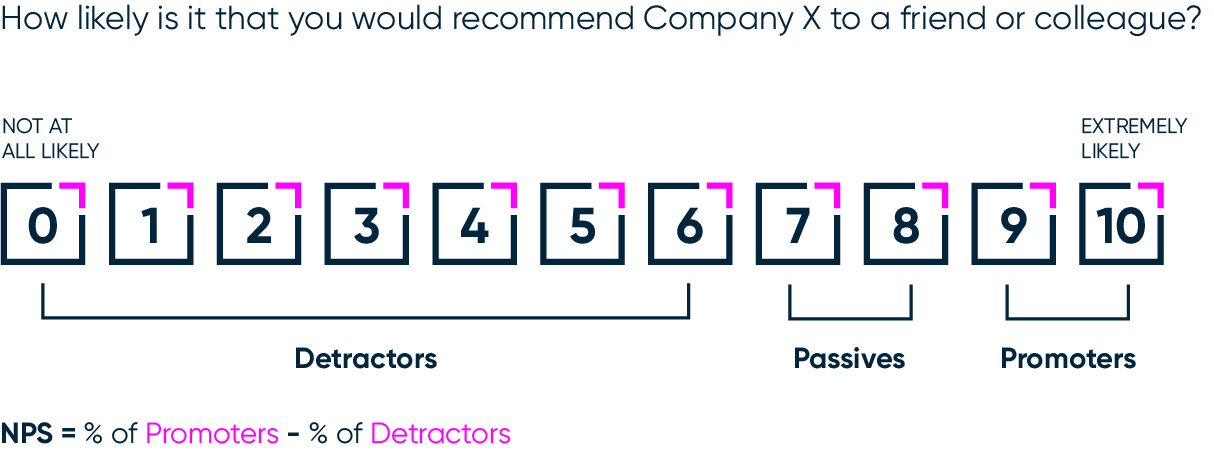

The classic NPS survey consists of two questions – the first is a rating question that asks for the likelihood that the customer would recommend the company to a friend or colleague. This is scored on a scale of 0 – 10, where 0 equals “not at all likely” and 10 equals “extremely likely.”

The second question is a follow-up open end designed to provide more context/color to the rating. This is usually written as “Please provide the reasons for your score.” The use of sophisticated text analytics can streamline the process of analyzing and developing ways to prioritize the feedback.

How does Net Promoter Score work?

The Net Promoter Score works by segmenting your customers into Promoters, Passives and Detractors, using a specific NPS formula. The segmentation helps to direct what actions should be taken; for example, Detractors often have issues that need to be resolved. The way in which these issues are resolved can determine if they become a lapsed customer or if they advance to being a Passive or Promoter.

Promoters are frequently sources for not only positive word of mouth (referrals, testimonials, etc.), but they are also often a valuable source for providing insight and direction on new products or enhancements to existing products and services.

After the introduction of NPS, the authors revised the approach to place more emphasis on the use of the data as opposed to the score itself. This involves thoroughly reviewing the open-end data to identify customer-level issues for resolution (which is called the “Inner Loop”) as well as thematic issues that, when resolved, will have the greatest impact on the greatest number of customer (this is called the “Outer Loop”).

How to calculate the Net Promoter Score?

So how is the Net Promoter Score calculated? NPS is based on the answer to one question: How likely are you to recommend Company/Product/Service X to a friend or colleague? Following the Net Promoter Score methodology, the scale used for this question is an 11-point scale, ranging from 0-10. Below is the formula to calculate your NPS rating.

Based on your customers’ response to this question, you’ll be able to classify them as Promoters (9 or 10), Passives (7 or 8) or Detractors (0-6). The Net Promoter Score is calculated by subtracting the percentage of Detractors from the percentage of Promoters.

Net Promoter Score calculation example:

Using the NPS equation, if you have 50% Promoters (i.e., half of your respondents gave you a score of 9 or 10), 20% Passives and 30% Detractors, your NPS score will be 50 – 30 = 20. The NPS scale goes from -100 (if you have only detractors) to +100 (if you have all promoters).

Does the NPS survey have to be just one question?

Although the scale itself is based on a single question, the Net Promoter system can be much more sophisticated. In its purest form, the survey consists of the combination of the NPS question followed by the open-end response. The rationale here is that short surveys are more likely to be completed. Practitioners frequently find that additional information is needed for more robust analysis. To address this, consider the following:

- Additional questions you might need to dig deeper into the areas you focus on. For example, satisfaction scores for various stages of the customer journey. It is important – particularly in a relationship survey – to keep these high-level.

- If you do need more information, instead of adding more questions to the survey, consider adding financial and operational data to provide more context to the data and offer additional analytical power.

But a survey based on Net Promoter Scores, like any other customer feedback, means nothing if you don’t take actions based on the insights you’re getting. The right mix of tactical, closed-loop actions (to rescue accounts about to churn for example), and strategic, long-term initiatives (for example improving your product offering), is key to the success of your program. And the NPS® score serves as a very intuitive, simple metric you can trend over time to evaluate the progress you’ve made.

What’s a good Net Promoter Score?

So, what is considered a good Net Promoter Score? With a scale ranging from -100 to +100, you can guess it’s not easy to determine what a good Net Promoter Score, or even an average NPS Score, is. Some might say there is no such thing, although of course there are industry benchmarks you can buy (or commission) to give you a sense of the average Net Promoter Score for your market.

A good NPS Score is one that:

- Compares favorably with your competitors in your region and market

- Increases over time based on the initiatives you take to increase customer experience

- Helps to give direction when it comes to taking customer-centric actions to deliver on your specific business outcomes

What are the Net Promoter economics?

The economics of Net Promoter are like the principles that govern customer loyalty. Satisfied, or even better, delighted customers, will spend more and recommend your company to their friends. They also cost less to serve. On the other hand, dissatisfied customers cost a lot more to serve as they tend to generate more complaints. And of course, they spend less and might deter new customers from joining by spreading negative word of mouth.

A key element of what the Net Promoter system adds here is the ability to correlate these principles to the Promoter, Passive and Detractor segmentation. For example, you can calculate the customer lifetime value of a promoter as opposed to a detractor, and therefore build a business case around whether the cost of turning a detractor into a promoter is worth the benefits.

Major organizations around the globe use NPS as their customer loyalty KPI. Its intuitive nature and correlation to financial metrics make it a powerful metric, but it’s in the way NPS scores help organizations to make better business decisions that the true power of NPS come into play.

Can Net Promoter Score apply for every business?

NPS is no magic bullet! As noted above, there are other metrics that may align with your business or process. The key is to take care in the development of your survey.

Regardless of the metric used, it means nothing if you don’t take the right actions with your customers to achieve the right business outcomes. With the hype around NPS, it can be easy to discard the key aspects below:

- NPS might not be the right metric for you (just like any other metrics)

- NPS might not help to drive change within your organization

- NPS might not correlate to growth in your business (for example in companies where recommendations aren’t important)

What are the steps you need to calculate your Net Promoter Score?

Here are the 6 steps to get started with calculating your Net Promoter Score.

- Implement a customer satisfaction survey using the NPS scale and the “Why” question

- Calculate the percentage of customers who answered 9 or 10 on the questionnaire (your Promoters)

- Calculate the percentage of customers who answered 0-6 on the questionnaire (your Detractors)

- Subtract the percentage of Detractors from the percentage of Promoters

- The number you now have is your Net Promoter Score

- Most importantly – Act on what your customers have shared with you, so you can work on increasing your score over time, and drive business results

This will help you get started but remember that fostering a customer-centric culture and finding ways to improve NPS in your organization isn’t easy.

How to increase your Net Promoter Score?

Make sure you use your current NPS to establish a baseline so you can evaluate future trends.

- Take tactical actions to close the loop with individual customers (or a selected group of them). Turning detractors or passives into promoters is a great way to increase your score (and more importantly your customers’ loyalty).

- Once you’ve gathered insights from a representative sample of your customer base, start taking more strategic actions, for example investing in product innovation or re-designing your billing system. Text analytics and/or advanced analytics using financial and operational data are tools to use to ensure you are focused on the most impactful initiatives.

- Leverage the knowledge of your employees. Employees often know first-hand what pain points customers experience; even better, they have great ideas on how to resolve them! Using a crowdsourcing approach can help engage all voices in the action process.

- Keep correlating your actions to the impact they’ve had on your NPS, so you can justify further investments in customer experience.

- Now correlate your Net Promoter Score to your business KPI’s (customer churn, revenue, cost of acquisition, etc.) so you can demonstrate the impact of customer experience on the bottom line.

- Empower everyone in your organization to act at their level and understand how they can influence customer loyalty – customer experience should never be just another initiative, but a driver of positive culture change.

Related articles

Everything you need to know about buying market research software

Everything you need to know about buying market research software Webinar synopsis: Tune in for a deep dive into the smartest way to evaluate, select, and secure the right research technology for your organization. We will expose the most common pitfalls, break down the key buying criteria, and show you how to build a rock-solid […]

Scaling customer experience in the age of AI: How intelligent automation is transforming CX

Scaling customer experience in the age of AI: How intelligent automation is transforming CX Scaling customer experience in the age of AI Simple, scalable, human: The new CX standard AI is transforming customer experience—and it’s doing more than just automating tasks. Today’s CX leaders are under pressure to do the impossible: deliver deeply personalized experiences, […]

Unlocking AI-powered customer insights with Forsta: Transform feedback into actionable intelligence

Unlocking AI-powered customer insights with Forsta: Transform feedback into actionable intelligence Webinar synopsis: Tune in for an exclusive deep dive into Forsta AI, where we’ll showcase how our powerful AI-driven tools—Summarize, Compose, and Recommend—are helping organizations turn raw data into actionable insights. Related resources

Learn more about our industry leading platform

FORSTA NEWSLETTER

Get industry insights that matter,

delivered direct to your inbox

We collect this information to send you free content, offers, and product updates. Visit our recently updated privacy policy for details on how we protect and manage your submitted data.